|

|

|

|

A Title Fee By Any Other Name May Not Be The Same

|

|

By now I'm pretty sure that everyone involved in mortgage originations knows that services required in connection with a loan for which a consumer may shop get disclosed in Section C of the Loan Estimate. If not, you probably shouldn't be originating mortgage loans.

|

|

For the most part, these fees are for the services provided by the closing agent for settlement related title services and costs, and the title coverage. It is important that these charges are disclosed as accurately as possible as these fees, along with the projected recording fees, will determine the base amount for the 10% tolerance test.

|

|

If a lender is not sure what closing agent will be used by a borrower they should disclose the fees of the title provider they show on their Service Provider List, which also must be given to an applicant within 3 business of making an application. This way, if the consumer selects the lender's provider, or does not select one and ends up using that provider, the fees charged at closing should be within 10% of what was disclosed.

|

|

"Should be" are the key words here. To ensure the disclosed fees are accurate a lender should negotiate the costs for the services that would be performed for the consumer in connection with the transaction with the providers on their list. These should include charges for settlement and related services, title premiums, searches and endorsement. The title agent and lender must be careful when initially listing the fees for the services disclosed. The fees must be for those services and expenses that will get charged at the closing and the amounts must also cover other miscellaneous charges that may not be disclosed.

|

|

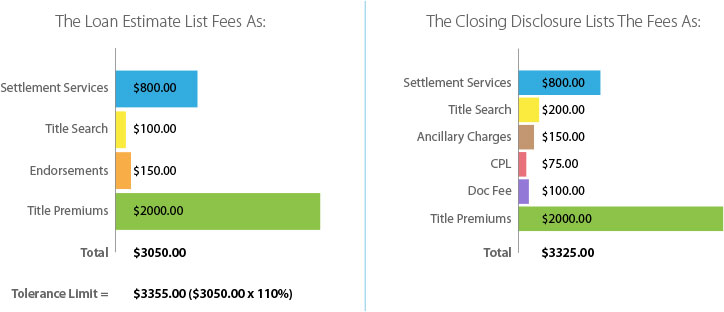

A fee that is not disclosed on the initial Loan Estimate may be charged by a settlement provider at closing. As long as the total of all fees for the settlement services do not aggregate greater than 110% of the fees initially disclosed in Section C, the undisclosed fees for title related services are allowable. However, if a fee is disclosed on the initial Loan Estimate, but not specifically charged at closing on the Closing Disclosure, that fee may NOT be included in the calculation of the base amount for determining the 10% tolerance. Confusing? Let's take a look at an example.

|

|

|

|

It would appear that the total title related charges at closing ($3325) are within the initial 10% tolerance limit based on the total of the fees disclosed on the initial Loan Estimate (limit is $3355). But wait...

|

|

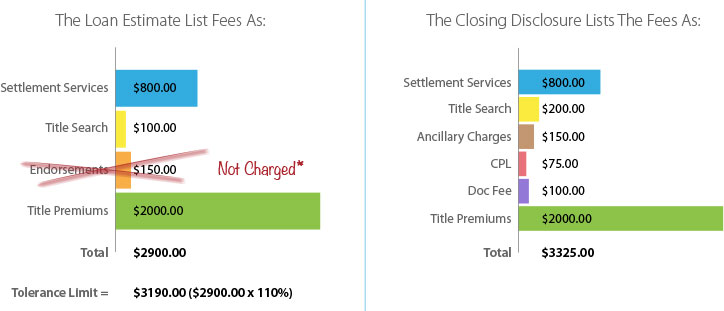

The fee for the endorsements disclosed on the initial LE at $150 was not charged at the closing. Since this fee for a service was disclosed but not specifically charged at the closing, this amount may NOT be included in the initial aggregate to determine the 10% tolerance limit. The new tolerance limit is determined as follows:

|

|

|

|

*As a direct result of the endorsement fee not being specifically charged and listed on the CD this loan now fails the 10% tolerance test requiring a cure of $135.00.

|

|

When in doubt it is better to disclose fewer specific fees and slightly increase those disclosed to cover other potential miscellaneous fees. For example a fee for "Settlement Services" could encompass the closing fees, CPL, searches and endorsements. As an alternative a lender may negotiate a flat fee with their recommended providers to cover all related closing costs with the exception of the costs for the title insurance coverage. The fees may then be more specifically detailed at closing, if so desired, as long as their total is within the allowable 110% tolerance limit.

|

|

Remember these fees must be disclosed based on a good faith estimate of the projected required services. A lender may not artificially increase the fees so as to provide the consumer motivation to use a different provider, in an attempt to release the lender from any potential tolerance violations and cures. Under disclosing these fees may result in a serious cure amount due at closing.

|

|

If, in the end, the borrower chooses their own provider, then all bets are off and the lender is released from any tolerance limits for the fees for the services for which the borrower selected the provider. However, the lender then faces other challenges in potentially dealing with a closing agent/attorney with which they are not familiar. It's always something...

|

|

Be very careful to disclose the Section C fees accurately to include the fees that will be charged at the closing and listed on the final CD. To be safe you may choose to, disclose fees in aggregate to reflect a good faith estimate of the final charges without specifically detailing each fee on the Loan Estimate. This will leave some leeway at closing to detail the charges on the Closing Disclosure without affecting the tolerance limit.

|

|

You can review more information on the disclosure of fees and the tolerance limits in CFPB's TILA-RESPA Guide (See Section 7.7).

|

|

The rules for the good faith estimate of the disclosure of fees to the consumer have changed with TRID, or the "Know Before You Owe" rules, as CFPB refers to them. It's time to play different.

|

|

|

— Mike Vitali - SVP/Chief Compliance Officer

|

|

|

Mike Vitali is SVP/Chief Compliance Officer for

LoanLogics. He has over 40 years of experience in all

facets of mortgage lending. Just prior to coming to

LoanLogics, he served for more than 12 years as an EVP

and Chief Risk Officer for a major national lender. He

also served as legislative chair for both the MBA of

Greater Philadelphia and MBA of Pennsylvania, and is a

member of several task forces dealing with compliance

issues for the National MBA.

|

|

|

|

|

|

|

|

|

|

This material is provided as a general information service

by LoanLogics, Inc. and its applicable subsidiaries and

affiliates ("LoanLogics"), and is not intended to provide

financial, regulatory or legal advice on any specific

matter. The information contained herein reflects the views

of LoanLogics and sources reasonably believed by LoanLogics

to be reliable as of the date of this publication.

LoanLogics does not make any representation or warranty

regarding the accuracy of the information contained in this

material, and there is no guarantee that any projection,

forecast or opinion in this material will be realized. Any

links provided from outside sources are subject to

expiration or change. © 2016 LoanLogics, Inc. All

Rights Reserved.

|

|

|

|

|

|

|

|

|

To print this email, view in browser (see link below).

|

|

|

|

|