Resource Library

-

Webinar, Video & Podcast Library Webinars Live Weekly Demo of the LoanBeam® Income Suite Verification Services Webinar HousingWire's Mortgage Tech Virtual Demo Day -IDEA® OnDemand

Videos LoanLogics® Company Overview LoanBeam® Income Calculation Suite Loan Quality Management with LoanHD® Data and Doc Processing with IDEA® Services IDEA® for MSR Transfer LoanHD® Investor Module for Correspondent Loan Acquisition. LoanLogics HMDA Complete™ Visit our LoanLogics YouTube page for more videos.

Podcasts Friction-Free B2B Mortgage Commerce – A Podcast Series Subscribe Now Freddie Automated Servicing Transfer (FAST®) Tool - LoanLogics Provides Technology MERS® Annual Compliance Reviews - Expert Tips to Prepare MSR Acquisition - How Automation Brings Time-Saving Efficiency -

The Double Act of Human and Machine

Improve profit, enable safe loan commerce and reduce industry risk.

Read White PaperWhite Papers Library The Double Act of Human and Machine Field Guide for the Care and Feeding of Digital Labor “Big” AI Driven by Today’s Machine Learning How to Get the Most from Your MERS® Annual Review For Mortgage Loans, Audit Mastery Takes Technology HMDA Automation Reporting Technology Blueprint to Improve Correspondent Loan Acquisition -

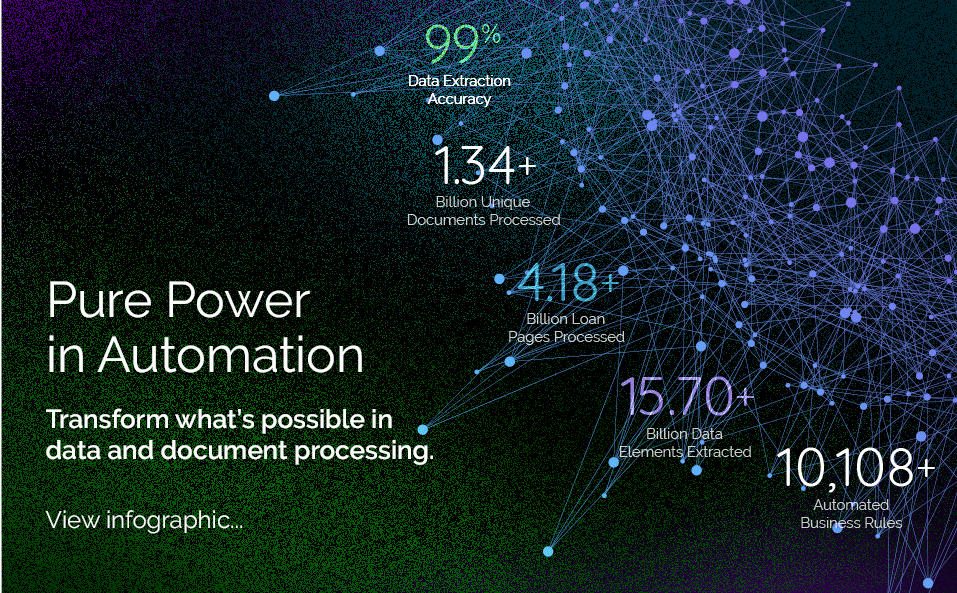

Transform your data and

document processing.Machine learning and rules-based

Get it now

automation creates purified data.Infographic LibraryIn-line Doc Processing - The Advantages of Going Cloud-Native Loan Quality Management - Accomplish Your Mission in Loan Quality MERS® Compliance - A Calendar for Better Execution Data & Doc Processing - Pure Power in Automation Correspondent Loan Acquisition - Integrated Technology Benefits HMDA Audit Efficiency - Report with Purpose, not for Purpose MSR Acquisition - Streamlined and Friction-Free Transfers Report Builder - Monitor and Improve Loan Quality Production -

Case Studies Library EMM Loans - true partnership with audit services team has resulted in greater value for both organizations Pennymac – 11-year partnership contributes to LoanLogics’ rapid ramp up of IDEA® Toll Brothers Mortgage Company – outsourced quality control to support business growth Logix Federal Credit Union - consistent, accurate self-employed borrower income calculation, written into company policy Summit Funding - moved to technology-enabled, in-house quality control resulting in 40% savings Credit Plus – doubled production for its pre-funding and post-closing QA/QC offerings CMC Funding – streamlined MSR boarding process with 70% cost savings

-

Collateral LibraryLoanLogics® Company Overview IDEA® Data and Doc Processing Services IDEA® Document Processing Technology IDEA® for MSR Transfer Services LoanBeam® Income Calculation Technology (Self-employed) LoanBeam® Income Calculation Technology (Wage Earner) LoanHD® Loan Quality Audit Services LoanHD® Loan Quality Platform Technology LoanHD® TRID Compliance Workflow Automation LoanHD® HMDA Audit Automation Tools LoanHD® Investor Module for Loan Acquisition MERS® Independent Third-Party Annual Review Service

Collateral LibraryLoanLogics® Company Overview IDEA® Data and Doc Processing Services IDEA® Document Processing Technology IDEA® for MSR Transfer Services LoanBeam® Income Calculation Technology (Self-employed) LoanBeam® Income Calculation Technology (Wage Earner) LoanHD® Loan Quality Audit Services LoanHD® Loan Quality Platform Technology LoanHD® TRID Compliance Workflow Automation LoanHD® HMDA Audit Automation Tools LoanHD® Investor Module for Loan Acquisition MERS® Independent Third-Party Annual Review Service